Watching your long-term investments grow is often compared to watching paint dry. Don’t get me wrong—everyone should do it. Over five years, you may see excellent returns. But in a shorter window, say six months, if you’re sticking to ETFs, performance may feel stagnant—unless you happened to buy at an exceptional entry point during a volatile period.

Take this past April as an example: SPY (an ETF tracking large-cap U.S. stocks) bottomed at 496.5 on April 8. As of this writing, it’s at 659—an increase of ~33%. That kind of movement is rare, though, and most of the time, long-term investing is a slow burn.

Short-term trading, on the other hand, can deliver outsized returns in a 2–6 month window—but only if you know what you’re doing. It’s riskier, and it requires discipline. This blog is about how I taught myself to trade, the mistakes I made, my returns, and what I learned in my first year.

Recap of My Journey

March 2020 – August 2024: Long-term investing only. Sporadic buying, never selling.

What I did right:

- Bought Amazon: +54% unrealized gains. Entry points weren’t great, but time in the market paid off.

- Bought Nvidia: +751% unrealized gains. Accidentally nailed my entry during a bear market when my overall portfolio was down 30%.

- Bought SCHB (ETF): +139%—solid performance.

Takeaway: Nothing beats buying during a bear market. Too bad I did so little of it in March 2020, and 2022–2023.

What I did wrong:

- Bought Zoom and Moderna near their all-time highs, without recognizing the pandemic-driven hype was fading.

- Relied on Motley Fool stock picks without realizing such services have their own agendas.

By August 2024, I finally checked my portfolio after long stretches of ignoring it—another mistake. While I was up over 30% overall, I had $20K in unrealized losses from poor trades.

I had an epiphany: I realized I could use short-term trading to generate profits and erase my bad bets. What began as a way to wipe the slate clean grew into something much bigger.

What Came Next:

I threw myself into self-education.

- Learned to read technical indicators and identify solid entry and exit points.

- Explored trading Discords—risky environments for the naive, but goldmines for the careful observer willing to ask the right questions.

- Discovered trading news bots, and dove into topics like share dilution, short selling, volume, and float.

- Experimented with strategies that felt safe to me, honing discipline and learning to balance fear and greed.

Most importantly, I taught myself how to trade without anxiety.

At first, my stress levels were unbearable. One panic sell from mistakes every new trader makes cost me a big loss. That was the turning point—I realized no amount of profit is worth trading with constant fear. So I reworked my strategies until I found approaches that felt sustainable and calm.

2024: The Turning Point

The last five months of 2024 were pivotal.

- Launched my first class on November 5, 2024 (election night)—and with it, Trading with Smarts (TWS) was born.

- Wiped out $17K in long-term losses, plus the hit from my big panic-sell mistake.

- Closed the year at breakeven overall, but with invaluable experience.

I also settled into a rhythm: small, controlled trades. Never risking more than a tiny fraction of my portfolio—usually under 1% of my brokerage cash per trade. That shift alone helped me trade without fear.

Results So Far

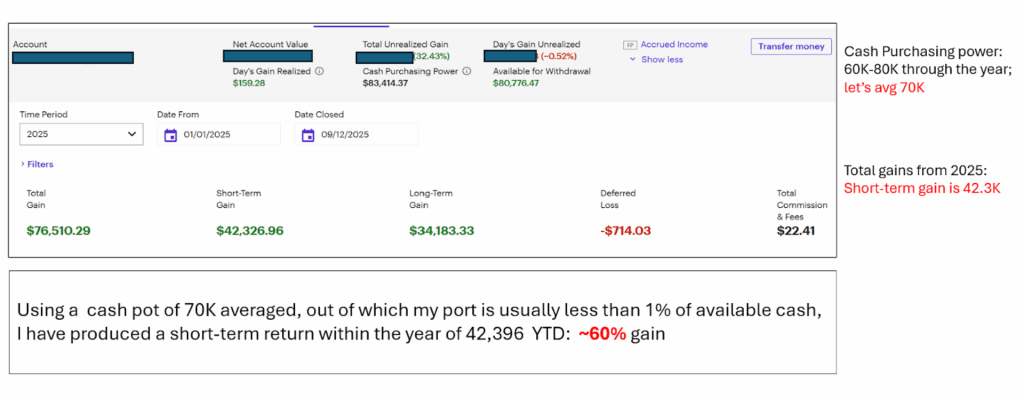

Using about $70K of trading capital (it has varied between 60-80K all year), I’ve built $42K in short-term gains—a ~60% return.

For comparison, if I had put that same cash into SPY on April 8, I’d be up 33%. I’m incapable of being reckless enough to put most of my cash into a single play on a single day, so my dollar amount gains would be much lower.

This illustrates the advantage of repeated, informed bets over one isolated longer-term bet.

Some will say this gain is puny. I’ve actually come up against that from reckless traders who want much bigger wins. But for me, small wins are enough.

The aim of trading is not to get rich quickly - it is to slowly increase my net worth in a steady, sustained manner that does not endanger my capital or give me palpitations.

Note: While I’m building short-term gains, I’m also making highly selective long-term buys, given that the market is at all-time highs. When the next major crash comes, that’s when I’ll make substantial long-term entries. Timing the market isn’t easy, but with patience, knowledge, strategy, and discipline, you can make it work in your favor.

What I’ve Learned

There’s no perfect formula. You’ll never maximize every opportunity. You’ll never trade perfectly.

But what you can do is:

- Be decisive and informed.

- Protect your capital.

- Learn from mistakes without beating yourself up.

- Build discipline.

- Build intelligent strategies that will get out of bad trades with profit

- Trade without anxiety

That’s the heart of my philosophy—and the foundation of what TWS teaches.

For more information on classes, click HERE